这次的业绩,表面上看来还是令人“失望”。其实,这次公司有不错的表现。

The latest quarter result looks 'disappointing' again. In fact, the company is running on correct path.

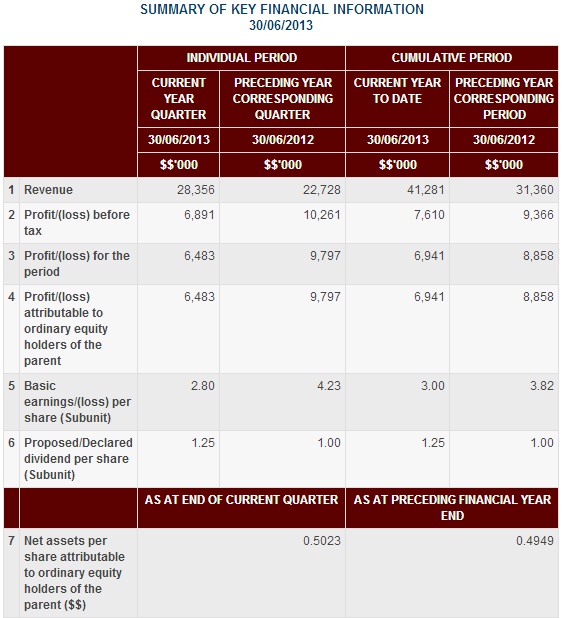

Source: http://www.bursamalaysia.com/market/listed-companies/company-announcements/1383077

这次的重点,应该放在销售量和经营开支。看了以下的图表,应该能发觉其中的奥秘。我所看得到的是,订单维持和成长的现象。

For this round, the focus should put on revenue and operating expenses. By looking at below table, you may find the answer. From what can I see, the order at least maintain at this level and there is room for further growth.

管理层对接下来的评语,还是很积极的一面。如果你是一位有耐性的投资者,以现在的价钱,我还是觉得没问题去守和慢慢累积。

From the prospect highlighted by company, still looking good on its growth and mainly through expansion. Personally, I feel it still worth to hold or accumulate slowly if you are patient enough.

Source: http://announcements.bursamalaysia.com/EDMS/edmswebh.nsf/all/15A7C036BBA7C5EF48257BDF005D8593/$File/ViTrox%20-Q2'13.pdf (page 7)

关于公司的盈利率的看法:

其一,为了要抢占市场份额,降低产品的价钱是可理解的。这些都是属于竞争性的付出。产品便宜,打出名堂,往后就以销售量来平衡回公司的盈利。

其二,公司最值钱的资产就是员工。新科技的研究和开发,都是靠他们。新产品必须一直推出,才能继续生存得更好。这些都是细水长流的费用。如果某个产品卖不多,盈利率自然会变低,因为研究和开发产品的必须费用已经是固定了(付出了)。以同样的理论,如果某个产品卖的特别多,盈利率自然会变得比较好。在市场慢慢复苏,消费能力提高,订单自然变的好。一样的花费(R&D),卖得多,盈利率的数目又变得不一样了。

A view on Profit Margin:

First, in order to capture better market share, lower the product price to make it more attractive is consider reasonable. This is a normal counter measure you have to pay off. If your product is consider cheap or reasonable, you will able to create the popularity and customer's confident. The return is to gain more selling volume and push up your earning.

Second, employee is the most important assets for the company. They are the one to make new product through R&D and make the company always stay at the front line in technology world. All this required continuous expenses. If product selling volume is low, the profit will lower by R&D expenses that already spend. At other word, when product selling volume is high, the same expenses will able to generate better revenue and the profit margin will increase accordingly. Profit margin will bounce back significantly when the market is recovering with better orders.

其他关于公司的资料:

1. 本地顾客占了33%的盈利。其余的67%的盈利都是由外地贡献。台湾,墨西哥,还有一个国家(忘了)占了大部分。

2. 主要以美金交易。本地的市场有一半也是以美金交易。

3. 已经开始打入电子业以外的生意。比如:医药,车业,等等。

4. 新厂已经用了一半。(空间放机械,必须品。并不代表产能率。)

5. 重复性的收入,通常都是产品卖给顾客后的三,四年所提供之类的服务。现在贡献很少,四,五年后才会比较明显。

Additional information related to company:

1. Local customers captured about 33% of revenue. Another 67% is from oversea customers. Taiwan, Mexico, (forgotten another one), are the main contributors.

2. Transaction mainly is in USD. Half of the local sales also dealing in USD currency.

3. Product is not only applicable in E&E, but also in other sectors like medical, automotive, etc.

4. The new factory, half of the space already occupied. (Equipment and necessary things, but does not mean to capacity usage).

5. Contribution from recurrent income like after sales service & upgrade feature, is still low. Expect need a longer time, 4-5 years to see a better figure.

2 comments:

虫虫大大,最近vitrox 的股价终于有起色了,从0.85上到 rm 1.00了。

本来应该是可以期待光明前景的,但是今天看了bursa的文告显示,大股东们出了不少的票....

请问你觉得这样是不是要跑路了?如果不是,那为什么大股东却要出货呢?

小弟想要听听你对大股东们这些卖货动作的解读看法....

谢谢。

股东卖票不一定是坏事。要如何比较有把握去预测是好是坏,其实可以从公司的基本面和大方向去思考。

我的建议是继续守下去。。。

Post a Comment