(No English version available for this analysis as it is old thread.)

公司的条件:

1. 未来: 预测未来五年的revenue可以增长一倍。不代表net profit会同步,因为生意的竞争。强烈的竞争,也许margin会维持在比较低的水平。

2. 底线: 股息>6%。如果经济放緩(不太糟糕),公司擴充的收入,可以平衡回公司的损失。自然也可以保持现有的股息。当公司的盈利继续地成长,股息自然会提高。

3. 股价: 预测现价在未来2-3年的Forward PE是大概>5, <7。

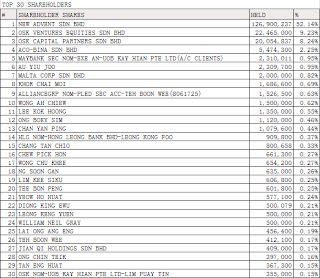

4. 信用: 顾客有名,可靠。管理层讲到做到(事实证明)。老板人品好(今天才收到的风声 )。三十大股东,基金占了十位。

5. 生意: 属于有週期。生意模型可以生存多几个十年。预测未来几年的需求会不错。还有大概38%的CAPEX会用来建厂/买地/买机械/收购子公司。手上的订单可以忙到年尾。

配合市场的走势:

1. 油价:起,需求增加。

2. USD/MYR:起,出口产品可以多赚汇率。

3. 原料:起,原料成本高,完成品卖价高。跌,原料成本底,完成品卖价底。凡是短期内有大波动,公司的盈利会有影响。最适合投资的时机是原料导致公司出现亏损的时候。

投资要做到,悄悄地买入,轰轰地卖出~

。。。。。

问1) 公司主要客户以油田开发为主,油田开发的budget allocation应该比市场油价走势delay几个quarter至一年左右。 可以看到油价在2008peak,一番的盈利在2009peak. 油价2009见底,一番2010-2011见底。油价2010-2011回升,一番2011-2012回升。 油价现阶段属于见顶吗?如果是,一番接下来一年的业绩会如何?

答1)客户也需要maintainance的嘛。油田开发当然是更好。两者占了多少我不懂。接下来的油价,我觉得会比较稳,毕竟美国都还没大选。我讲过,油价起,需求增加。所以会看到delay的效果咯。你也看漏了他的新厂(stainless steel)是在亏着钱滴。 原因?自己看报告就懂了。公司不会乱乱擴充生意滴。我也相信公司,因为他们讲过的事情,都一一实现。

这个股,我都打算做中长期。所以不怕股价跌,因为我要买在低迷的时候。我买入他,是因为要他4-5年后的成长。业绩可以增倍(revenue double up. net profit 可以增长50%我已经很满意了),到时大众看到了,会有如何的反应?

Johor这个大工程也占了一个很重要的条件来push up未来的业绩。希望能实现。

Petronas: Rapid project on schedule

Johor RM62bil refinery and petrochemical project timely

问2) 公司短期债务高达~170mil, 现金部位则只有~100mil. 如果欧债爆发,会不会有周转风险?

答2) 完全没怕过。客户都不是芝麻绿豆。加埋应收帐,要应付有多难。也可以随时跟大卡借钱。公司的prospect好,给他们好甜头,自然不成问题。 知道为何公司的stocks也那么高吗?去看公司的video clip就懂了。这个忧点,也是公司的优点。

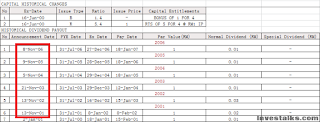

问3) 公司好像过度大方。ESOS竟然高达46.454mil units(exercise price 0.67), 大约占了总股数的10%。 另外也有~75mil (exercise price 0.60),大概16%. 可以预见股价过了0.67之后,会面对非常大的上升主力。如果盈利跟不上,EPS的growth在短期内也非常难突破。

答3)以现在的价钱,ESOS竟然为公司从员工那边赚一笔。代表我这个股东还好过员工。你讲我才懂。 那些warrant可以不用管。毕竟是2020年才过期。给你,你会现在去换吗?还要多给60sen哦。:lol 就算是换了,公司给可以拿到60sen进帐目哦。我反而觉得现在的公司对那些ESOS与Warrant的股东拿利益,不是过度大方。做么老板要那么坏?

The ESOS options granted to employees, and the warrants are anti-dilutive and hence the calculation of diluted earnings per share for the current period does not assume the exercise of the ESOS options and warrants.我反而比较赞同ESOS多过private placement。如果我是老板,我会回报帮我搞好公司的员工。Private placement多数只是益某些等肉送上口的人吧了。如果你看了报告,你会懂老板是个怎样的人。

公司的loan stock才会dilute earning。公司要借这笔钱,当然要给LS holder甜头咯。你不是LS holder,就要靠公司好利用LS这笔钱。自然间,股东也是有好处。LS这笔钱,暂时还剩下大概38%。

。。。。。

4-May-2012

Pantech on track for 2-digit earnings growth

http://www.theedgemalaysia.com/i ... arnings-growth.html

2-May-2012

TA maintains 'buy' on Pantech

“The company’s carbon steel division has orders until end of this calendar year and is currently ramping up capacity to meet rising demand, especially from the oil and gas sector,” the broker said in a research note on Wednesday.

http://www.btimes.com.my/article ... icle/#ixzz1y9CGxrKM

11-May-2011

新產線投產‧大型計劃帶動需求‧鵬達明年有望增長28.7%

http://biz.sinchew-i.com/node/47013

6-May-2011

Pantech plans RM150mil investment over five years

http://biz.thestar.com.my/news/s ... 618577&sec=business

。。。。。

。。。。。

PANTECH EXPECTS DEMAND FOR ITS PIPE PRODUCTS TO

INCREASE

CLASSIFICATION:

TYPE:

14 November 2011

PANTECH GROUP HOLDINGS is confident on the outlook going forward and that its expansion plans are progressing on track. The recovery in demand for the Company's pipes, fittings and flow control (PFF) products is expected to gain traction, both in the domestic and export markets.

2QE AUG 2011 RESULTS SHOW IMPROVEMENT

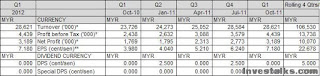

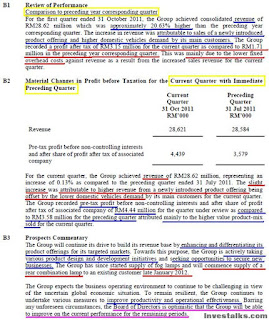

The Company's earnings for 2QE Aug 2011 showed Turnover improving to RM100.6m, up 3.5% from same quarter a year ago and up 5.5% QoQ. Trading sales accounted for roughly 60% of total Turnover while the manufacturing arm contributed to the balance.

The recovery in domestic demand, which accounts for the bulk of the Company's trading sales, is still sluggish � although off the lows. As a result, margins from the trading arm are still at the lower end of its historical range. MANUFACTURING DIVISION FARING BETTER

The manufacturing division is faring better on strong recovery in overseas markets. Sales continued to trend higher to RM40.6m for 2QE Aug 2011 compared with RM25m same quarter a year ago.

The carbon steel manufacturing facility in Klang is operating at full capacity. Operations at the new stainless steel manufacturing plant in Johor Bahru are also progressing well. All six initial production lines are up and running at almost full capacity. The lines broke even at end-2QE Aug 2011 and should start to contribute positively.

Lower losses from the new manufacturing plant more than offset the slight contraction in Trading EBIT. EBIT for manufacturing improved to about RM3.4m for 2QE Aug 2011, up from RM1.3m in the immediate preceding quarter. Net Profit improved to RM7.2m in 2QE Aug 2011, up from RM6.2m in the first quarter. STRENGTHENING DEMAND

Despite prevailing global uncertainties, the Company is cautiously optimistic. The O&G and oil palm-related sectors collectively account for the bulk of PANTECH's sales for pipe fittings and flow control products.

Despite domestic demand still being somewhat sluggish, capex in the O&G sector is expected to be quite robust for the foreseeable future.

National oil company, PETRONAS is reported to be planning capex of RM250 bil over the next five years to develop new projects, including marginal oilfields, as well as undertake enhanced oil recovery from existing oil fields. Private sector projects such as DIALOG GROUP's Pengerang deepwater petroleum terminal are also expected to spur greater investment in the O&G-related sectors in the country going forward.

The gradual rollout of these projects will translate into greater demand for downstream support services, including demand for PANTECH's pipe products.

PRODUCTION PLANTS OPERATING AT FULL CAPACITY

THE ASIA ANALYTICA reported Nov 2, 2011 that PANTECH's manufacturing plants are running near full capacity. The division has recovered quite smartly from the slump in overseas demand in the aftermath of the global financial crisis. Sales hit a trough for 2QE Aug 2010 and have been trending higher since � despite the strengthening of the Ringgit. The weaker US$ translates into lower sales for the company in Ringgit terms.

CARBON STEEL PLANT

The Company's carbon steel PFF manufacturing facility in Klang is effectively running at full capacity. To cater to the expected demand growth, a factory is being built on a piece of land adjacent to its existing plant. The additional machinery to manufacture, primarily, high frequency induction long bends, are slated to commission by end-2011. The factory will also house a heat treatment facility.

PANTENCHis in the midst of adding machinery for another four lines at its new stainless steel facility. The additional lines will expand the current production range to include bigger-sized pipes and also fittings.

If all goes to plan, rated production capacity at this plant will rise to 13,500 tonnes per annum by early 2012 from the current 7,000 tonnes and will be reflected in the Company�s FY13 earnings. Total Capex is estimated at RM40m to RM50m for FY12-FY13 respectively. FULL ORDER BOOK FOR CURRENT FY

The manufacturing division has already secured a full order book for the rest of the current financial year.

PANTECH is also exploring options to further expand its range to encompass higher value and margin alloy products such as copper-nickel, duplex and super duplex pipes and fittings that are corrosion resistant.

Such a move would expand its customer base and market reach and is the final piece in PANTECH's five-year plan to hit the sales target of RM1 bil by FY15. The Company expects manufacturing sales to account for at least 40% of total sales. Domestic demand will also account for a higher percentage of manufacturing sales, currently derived mainly from exports, as a result of import substitution.

。。。。。

PANTECH GROUP EXPECTS MANUFACTURING REVENUE TO RISE TO 50% OVER 3 TO

5 YEARS

CLASSIFICATION: PRESS RELEASES/REPLIES/DIGEST

TYPE: News Digest

15 November 2010

PANTECH GROUP HOLDINGS expects that 40% to 50% of the Group's Revenue will come from the manufacturing segment over the next 3 years to 5 years from about 20% at present. Speaking after the Group's EGM on Oct 28, 2010, ED, ADRIAN TAN said the Group was intent on the shift to increase its revenue base.

PANTECH is involved in the supply of high pressure seamless and specialised steel pipes, fitting and flow control solutions such as valves, actuators and controls. It also manufactures carbon steel fittings.

At the EGM, shareholders approved a proposed 1 for 5 BOnus Issue, an ICULS issue of up to RM77.25m with warrants attached on the basis of 1 warrant for every 10 ICULS subscribed for.

CLASSIFICATION: PRESS RELEASES/REPLIES/DIGEST

TYPE: News Digest

15 November 2010

PANTECH GROUP HOLDINGS expects that 40% to 50% of the Group's Revenue will come from the manufacturing segment over the next 3 years to 5 years from about 20% at present. Speaking after the Group's EGM on Oct 28, 2010, ED, ADRIAN TAN said the Group was intent on the shift to increase its revenue base.

PANTECH is involved in the supply of high pressure seamless and specialised steel pipes, fitting and flow control solutions such as valves, actuators and controls. It also manufactures carbon steel fittings.

At the EGM, shareholders approved a proposed 1 for 5 BOnus Issue, an ICULS issue of up to RM77.25m with warrants attached on the basis of 1 warrant for every 10 ICULS subscribed for.

。。。。。

PIPES & FITTINGS MAKER LOOKING FORWARD TO HIGHER

DEMAND

CLASSIFICATION: ACCOUNTING/AUDIT NOTIFICATION/ANALYSIS & BUSINESS PROJECTIONS

TYPE: Short Analysis / Reviews

21 May 2010

PANTECH GROUP is expecting that demand for its pipes, fittings and flow control (PFF) products will pick up pace over the coming months said research house INSIDERASIA in a note on Apr 29, 2010.

The global economic recovery has gained traction while the credit crunch is easing, making it easier to obtain financing. Crude oil prices have strengthened on the back of expectations the recovery will support rising demand going forward. Crude oil futures have stayed well above US$80 (RM256.80) per barrel in recent weeks. This, in turn, has bolstered confidence for oil companies to initiate new exploration and production activities and revive projects postponed during the worst of the financial crisis. DECLINE IN 2009

The sharp decline in demand, both domestic and overseas in 2009 saw PANTECH's sales falling 21% YoY for FYE Feb 2010. The trading business � mostly domestic sales � contracted by about 14% YoY while manufacturing, primarily for exports, contracted a sharper 45% YoY. The drop in utilisation resulted in lower operating margins. After adjusting for one-off charges and writebacks, PANTECH's Net Profit declined 33% YoY for FYE Feb 2010. PLANT RUNNING AT FULL CAPACITY

With its largest customer segment in the oil and gas sector,' its manufacturing plant is running back at near full capacity. We estimate the Company's current order book is sufficient to keep it busy for the next three to four months said INSIDERASIA. SALES & NET PROFIT ESTIMATES

INSIDERASIA estimates that sales will resume growth, by roughly 10%, to RM442m for FYE Feb 2011. The manufacturing arm is expected to register strong double-digit growth, from a low base in FY10, but the trading division will still account for the biggest share of total revenue.

INSIDERASIA also estimates that Net profit will improve to RM51.4m, which is about 11% higher YoY after adjusting for one-off items like start-up costs related to its new manufacturing outfit � which should see margins improve over the longer term.

INSIDERASIA estimates PANTECH's shares trading at attractive forward P/E of only about 6.7 multiples at end Apr 2010.

Manufacturing expansion is expected to double revenue in five years. The Company first started manufacturing a segment of its PFF product range, primarily carbon steel fittings like elbows, tees, end-caps and long bends, back in 2000. GOOD OVERSEAS REPUTATION & EXPANDED CAPACITY

PANTECH has established a good reputation among overseas clients, which currently account for the bulk of manufacturing sales. Capacity too has been gradually expanded to the present 16,500 tonnes per year. This will be further raised to 22,500 tonnes once ongoing construction for a brand new manufacturing facility in Johor Bahru is completed, targeted before end-2010.

The new plant is slated to produce higher value-added stainless steel PFF products. Part of the output will go towards import substitution for its domestic trading business while the remainder will likely be exported. The plan is to expand capacity at this new plant further, by up to another 6,000 tonnes, while its output range will be widened to include alloy-based pipes and fittings. SAUDI JV SLOWER PROGRESS

Its JV in Saudi Arabia is progressing at a slower pace. The venture, to produce carbon steel PFF products, will give PANTECH a leg up in the lucrative Middle East market, catering to major oil companies like SAUDI ARAMCO (the state-owned national oil company of Saudi Arabia) as well as downstream customers such as SAUDI BASIC INDUSTRIES (one of the five largest petrochemical companies in the world). CAPEX TO BE HIGH IN NEXT FEW YEARS

Capex will be high over the next few years, totalling an estimated RM220m or so for FY11-FY13.

INSIDERASIA is of the view that PANTECH's Balance Sheet is strong enough to support its expansion plans and maintain a fairly good dividend payout. Gearing stood at just about 24% at end-FYE Feb 2010 with Net Debts totalling RM56.9m.

The Company declared single-tier dividends totalling 4.2 sen per share for FYE Feb 2010, including a Final Dividend of 1.2 sen per share, which is yet to be paid. That translates into a Net Yield of 4.6% for shareholders.

INSIDERASIA said that given the higher Capex to be incurred and dividends sustained at FYE Feb 2010 levels, gearing is expected to rise as high as 53%, which remains within the manageable range, before being pared back as the Company's returns improve once the new plant is operating at optimal levels.

CLASSIFICATION: ACCOUNTING/AUDIT NOTIFICATION/ANALYSIS & BUSINESS PROJECTIONS

TYPE: Short Analysis / Reviews

21 May 2010

PANTECH GROUP is expecting that demand for its pipes, fittings and flow control (PFF) products will pick up pace over the coming months said research house INSIDERASIA in a note on Apr 29, 2010.

The global economic recovery has gained traction while the credit crunch is easing, making it easier to obtain financing. Crude oil prices have strengthened on the back of expectations the recovery will support rising demand going forward. Crude oil futures have stayed well above US$80 (RM256.80) per barrel in recent weeks. This, in turn, has bolstered confidence for oil companies to initiate new exploration and production activities and revive projects postponed during the worst of the financial crisis. DECLINE IN 2009

The sharp decline in demand, both domestic and overseas in 2009 saw PANTECH's sales falling 21% YoY for FYE Feb 2010. The trading business � mostly domestic sales � contracted by about 14% YoY while manufacturing, primarily for exports, contracted a sharper 45% YoY. The drop in utilisation resulted in lower operating margins. After adjusting for one-off charges and writebacks, PANTECH's Net Profit declined 33% YoY for FYE Feb 2010. PLANT RUNNING AT FULL CAPACITY

With its largest customer segment in the oil and gas sector,' its manufacturing plant is running back at near full capacity. We estimate the Company's current order book is sufficient to keep it busy for the next three to four months said INSIDERASIA. SALES & NET PROFIT ESTIMATES

INSIDERASIA estimates that sales will resume growth, by roughly 10%, to RM442m for FYE Feb 2011. The manufacturing arm is expected to register strong double-digit growth, from a low base in FY10, but the trading division will still account for the biggest share of total revenue.

INSIDERASIA also estimates that Net profit will improve to RM51.4m, which is about 11% higher YoY after adjusting for one-off items like start-up costs related to its new manufacturing outfit � which should see margins improve over the longer term.

INSIDERASIA estimates PANTECH's shares trading at attractive forward P/E of only about 6.7 multiples at end Apr 2010.

Manufacturing expansion is expected to double revenue in five years. The Company first started manufacturing a segment of its PFF product range, primarily carbon steel fittings like elbows, tees, end-caps and long bends, back in 2000. GOOD OVERSEAS REPUTATION & EXPANDED CAPACITY

PANTECH has established a good reputation among overseas clients, which currently account for the bulk of manufacturing sales. Capacity too has been gradually expanded to the present 16,500 tonnes per year. This will be further raised to 22,500 tonnes once ongoing construction for a brand new manufacturing facility in Johor Bahru is completed, targeted before end-2010.

The new plant is slated to produce higher value-added stainless steel PFF products. Part of the output will go towards import substitution for its domestic trading business while the remainder will likely be exported. The plan is to expand capacity at this new plant further, by up to another 6,000 tonnes, while its output range will be widened to include alloy-based pipes and fittings. SAUDI JV SLOWER PROGRESS

Its JV in Saudi Arabia is progressing at a slower pace. The venture, to produce carbon steel PFF products, will give PANTECH a leg up in the lucrative Middle East market, catering to major oil companies like SAUDI ARAMCO (the state-owned national oil company of Saudi Arabia) as well as downstream customers such as SAUDI BASIC INDUSTRIES (one of the five largest petrochemical companies in the world). CAPEX TO BE HIGH IN NEXT FEW YEARS

Capex will be high over the next few years, totalling an estimated RM220m or so for FY11-FY13.

INSIDERASIA is of the view that PANTECH's Balance Sheet is strong enough to support its expansion plans and maintain a fairly good dividend payout. Gearing stood at just about 24% at end-FYE Feb 2010 with Net Debts totalling RM56.9m.

The Company declared single-tier dividends totalling 4.2 sen per share for FYE Feb 2010, including a Final Dividend of 1.2 sen per share, which is yet to be paid. That translates into a Net Yield of 4.6% for shareholders.

INSIDERASIA said that given the higher Capex to be incurred and dividends sustained at FYE Feb 2010 levels, gearing is expected to rise as high as 53%, which remains within the manageable range, before being pared back as the Company's returns improve once the new plant is operating at optimal levels.

《完》