管理层把经营开支控制到很好。也成功提高产品的销售利润率,应该开始有销售高利润率的新产品。香港那边没前途了。越南还需要时间起步。新厂也是需要时间。全部事情只是时间的问题。。。

I just provide a simple brief for this quarter result:

Company did very well in control the operating expenses. The profit margin managed to maintain at good level as well. I take a guess... this may due to launch of new product with higher profit margin. For Hong Kong segment, it is not impressive at all. Anyway, it is expected. For Vietnam operation, it is yet reflect any contribution but still in progress to setup the production. Still need more time to utilise the newly acquired factory/land. Just a matter of time for everything get better...

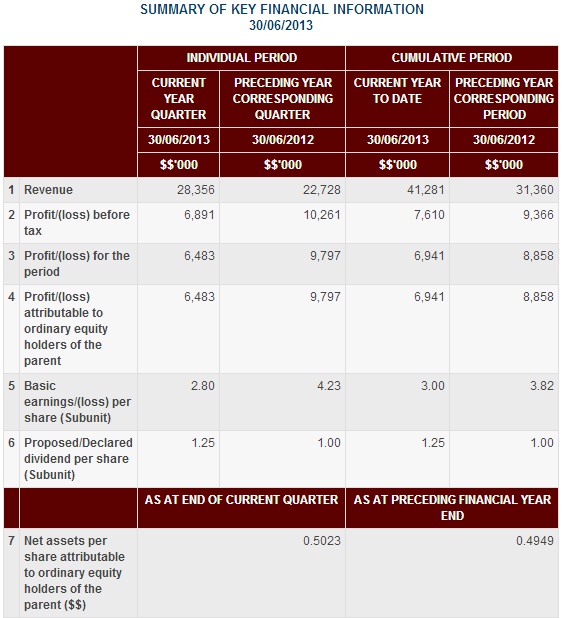

顺便送大家以下的一个图表。慢慢享受它的内涵。

Give an informatics chart for reference. Use your sense to analysis it.

Quarterly rpt on consolidated results for the financial period ended 30/6/2013

| UMS-NEIKEN GROUP BERHAD |

| Financial Year End | 31/12/2013 |

| Quarter | 2 |

| Quarterly report for the financial period ended | 30/06/2013 |

| The figures | have not been audited |

- Default Currency

- Other Currency

Currency: Malaysian Ringgit (MYR)

SUMMARY OF KEY FINANCIAL INFORMATION

|

INDIVIDUAL PERIOD

|

CUMULATIVE PERIOD

| ||||

CURRENT YEAR QUARTER

|

PRECEDING YEAR

CORRESPONDING QUARTER |

CURRENT YEAR TO DATE

|

PRECEDING YEAR

CORRESPONDING PERIOD | ||

$$'000

|

$$'000

|

$$'000

|

$$'000

| ||

| 1 | Revenue |

19,243

|

21,925

|

37,729

|

41,046

|

| 2 | Profit/(loss) before tax |

2,836

|

2,860

|

5,084

|

4,640

|

| 3 | Profit/(loss) for the period |

1,944

|

2,015

|

3,528

|

3,176

|

| 4 | Profit/(loss) attributable to ordinary equity holders of the parent |

1,944

|

2,015

|

3,528

|

3,176

|

| 5 | Basic earnings/(loss) per share (Subunit) |

2.47

|

2.53

|

4.49

|

3.98

|

| 6 | Proposed/Declared dividend per share (Subunit) |

0.00

|

0.00

|

0.00

|

0.00

|

AS AT END OF CURRENT QUARTER

|

AS AT PRECEDING FINANCIAL YEAR END

| ||||

| 7 | Net assets per share attributable to ordinary equity holders of the parent ($$) |

0.7800

|

0.7400

| ||