年对年的基本数据 @ Y-Y FA Comparison

重点:

1) 债务低,现金高(27mil属于固定存款,3.1mil短期投资),股息派发率在于60%~80%之间。

2) 应收帐有明显的提升。 工程多数属于政府批发,新加坡业务占多数,无需担心。

Keypoints:

1) Low debt, high cash position (27mil FD & 3.1mil short term investment), high dividend payout ratio at 60% - 80%.

2) Receivable significantly increased at recent year. Anyhow, most of the contracts are from government sector and Singapore segment is the main contributor. So, needless to worry.

季对季的基本数据 @ Q-Q FA Comparison

重点:

1)Q2'12 > Q3'12:收入明显提升了5.5mil。除税后盈利在于17.9%-18.5%。

2)以现有的工程合约,今年的EPS预测能够超越09年而重新创新高。

Keypoints:

1)Q2'12 > Q3'12:Revenue jump up by 5.5mil. PAT range at 17.9%-18.5%.

2) With current on hand contracts, expect this year's EPS can easily break its highest EPS (2009).

分部业绩报告@ Segment Report

重点:

1)新加坡业务占了收入的80%。其余的20%在大马。印尼的业务刚开始,还在亏损中。

Keypoints:

1)Singapore make the biggest contribution to the company sales (80%) and the rest 20% is generate from Malaysia market. Indonesia market still under development stage and still making loss.

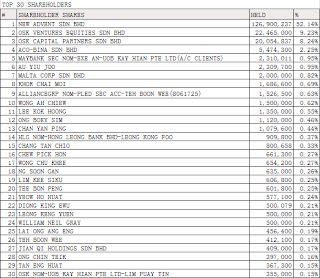

三十大股东 @ 30 Top Shareholders

重点:

1)没有基金在三十大。

Keypoints:

1)No investment fund among the 30 top shareholders.

资本及派息记录 @ Capital & Dividend Info

重点:

1)去年(FY11)股息给2.5sen。最高(FY10&FY09)股息为3sen。

2)今年的业绩提升,接下来的股息预测能重新回到去3sen。期待更高。

Keypoints:

1)Last year, FY11 dividend payment is 2.5sen. Highest dividend payment is 3sen (FY10&FY09).

2)This year result has improved significantly. So, expect the coming dividend payment will be able get back to 3sen. Anyway, hoping for higher.

其他:

“4.1.8 Change in MSC Status

Willowglen was granted the MSC status on 31 March 1998 by MDC. By virtue of this, our Company has been granted full pioneer status which accords our Company with five (5) years of income tax exemption on our statutory income commencing on 4 June 2002 and was further extended to 3 June 2012 for the maximum allowable period of ten (10) years”

Willowglen was granted the MSC status on 31 March 1998 by MDC. By virtue of this, our Company has been granted full pioneer status which accords our Company with five (5) years of income tax exemption on our statutory income commencing on 4 June 2002 and was further extended to 3 June 2012 for the maximum allowable period of ten (10) years”

》以上的免税受惠已经过期了。但是预测对公司的税后盈利不会有很大的影响。因为主要的盈利是从新加坡贡献。(注意:新加坡所得税@17%,而大马的所得税@25%。)

》Pioneer status income tax exemption benefit has expired. But, expect it do not make significant change to PAT since Singapore is the main contributor to company profit. (Note: Corporate income tax for Singapore is 17% & Malaysia is 25%)

简单预测接下来的业绩 @ Simple way to estimate the coming results

算法(预测性):

1)今年(近期)拿到的工程合约:

220512 - 17.99mil(必须在Aug14完成)《 预测每季贡献2.02mil

060812 - 9.70mil (必须在Mar13完成)《 预测每季贡献4.22mil

181012 - 5.64mil (必须在Dec16完成)《 预测每季贡献0.34mil

181012 - 4.32mil (必须在Jun18完成)《 预测每季贡献0.19mil

181212 - 12.37mil(必须在Jun14完成)《 预测每季贡献2.10mil

2)今年(近期)会完成的工程合约:

060909 - 7.50mil(必须在Mar13完成)《 预测每季贡献0.46mil

280111 - 9.50mil(必须在Dec12完成)《 预测每季贡献1.27mil

3)条件:(A)以Q2'12作为盈利底线来算(B)预测税后盈利率为17.5%(C)只是算能看得到的合约(过后再用折扣10%,15%,20%来给予更坏的预测算法)。

Calculation (estimation only):

1)Contracts awarded in this year (recent months).

220512 - 17.99mil(Complete by Aug14)《 estimate quarter revenue as 2.02mil

060812 - 9.70mil (Complete by Mar13)《 estimate quarter revenue as 4.22mil

181012 - 5.64mil (Complete by Dec16)《 estimate quarter revenue as 0.34mil

181012 - 4.32mil (Complete by Jun18)《 estimate quarter revenue as 0.19mil

181212 - 12.37mil(Complete by Jun14)《 estimate quarter revenue as 2.10mil

2)Old contracts will complete in this year (coming months).

060909 - 7.50mil(Complete by Mar13)《 estimate quarter revenue as 0.46mil

280111 - 9.50mil(Complete by Dec12)《 estimate quarter revenue as 1.27mil

3)T&C:(A)Benchmark Q2'12 sales as baseline(B)Estimate PAT of 17.5%(C)Only consider of visible contracts achieved from bursa/news. Follow by use discounted method (10%,15%,20%) to provide worse estimation for reference.

技术图@TA

《完》《END》

No comments:

Post a Comment