|

| UMS-NEIKEN |

http://www.unitedms.com.my/

http://www.neiken.com/index.htm

【UMS集团】[UMS-NEIKEN]

最近两年的收入都属于平平无奇的一间公司,看来没什么特别。其实,公司近两年的净盈利都有明显的增长。主要是净盈利率从3%提高去7-8%。公司的负债很低和现金流也挺不错。是一间非常健康的小资本公司。只有80mil的股数。

部分人都很怕投资在小资本的公司。主要原因是怕公司分分钟会关门大吉。不管什么投资,风险观察都很重要的。一间公司在经济风暴时,将会面临很大的考验,如果公司的净盈利率低,负债高,现金流不好会导致周转不来,等等。以刚刚讲的基本分析,【UMS集团】可以讲是很有能力撑得过这一关。

From the past 2 years' revenue record, it looks nothing special on this company. Basically, the company net profit margin has been improved significantly in past 2 years. Its rose from 3% to 7-8%. Company has a low debt position and its free cash flow is doing great as well. From this, we can see that it is a very healthy small cap company with only 80mil number of shares issued.

Part of the investors are afraid to invest in small cap company. One of the reason is afraid the company unable to overcome economic crisis. During economy crisis, company will fall into bankruptcy position if it come with low net profit margin, high debt, weak FCF, etc. From the FA, [UMSNGB] has shown its capability to overcome this situation.

|

| Y-Y Fundamental Analysis |

From the recent results, the average quarter eps is about 2sen. Since year 2011, the result is getting better and it become much more obvious during year 2012.

|

| Q-Q Results |

In 2012 annual report, in 30 top shareholders list, KP FELDA owns 7.52%. From BURSA announcement, it shown that KP FELDA share holding has been reduced to less than 5%. At the same time, YEO GUIK HIANG has increased her share holding percentage from 2.83%+ to above 5%. Suspect the recent changeover is made by them. Once the share holding changed, the share price has rose up significantly.

|

| Top 30 Shareholders |

From the segment report, business in Malaysia is increasing while HK business is falling down since year 2008. Vietnam operating has been stopped since year 2010. According to management, Vietnam will re-commence its operation in 2nd half of this year. In recent time, found many news and investors are saying good on investment in Vietnam. If it is truth, then it will be great for the company.

|

| Segment Report |

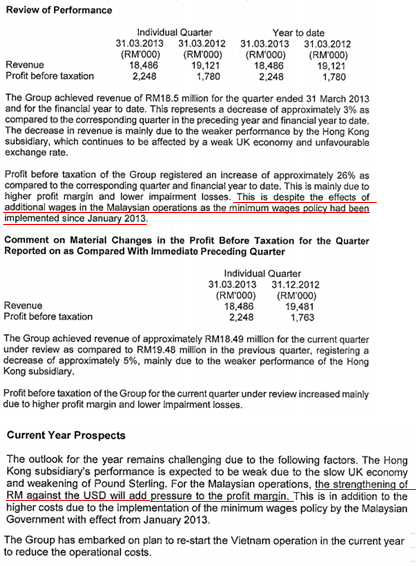

Minimum wages policy had been implemented for the company since January 2013. Surprisingly, its Q1FY13 result still able to maintain at EPS 2sen level. The strengthening of RM against USD will add pressure to company profit margin. Anyhow, USD is very strong against RM in recent time. It is a good news for company.

Source: http://announcements.bursamalaysia.com/EDMS/edmswebh.nsf/all/8BD11EB33147912548257B8B005D7B91/$File/UMS-Neiken%20Group%20Berhad%20-%201Q%20unaudited%20results%2031.03.2013.pdf (Page 13)

从2012的年报里,可以找到净盈利率提升的来源。管理层做了很多功夫在提高生产力,费用管理和库存管理。资产负债表能表现的那么好都是管理层把信贷控制和资金管理做的好的功劳。

管理层透露,最低薪金其实把公司的净盈利率压低了。为了减低成本,公司打算把越南的厂重新开始运作。以我个人的想法,这个举动可不是那么简单。老远跑去越南,当然想再次打入那边的市场吧!毕竟越南的基建和房地产应该还有很大的增长空间。

In 2012 annual report, we can found that the net profit margin improvement is due to improved operational efficiencies, tighter cost control measure and better inventory management. The Group's balance sheet is further strengthened through improved credit control and better funds management. To mitigate the higher labour costs resulting from the imposition of minimum wages, the Group will re-commence manufacturing operations at its existing factory in Vietnam. This is expect to be complete in 2nd half of 2013. I was thinking, this will be not that simple. I expect the company to further explore the Vietnam market with this move since the infrastructure and property sector still has a big room to grow.

Source: http://announcements.bursamalaysia.com/EDMS/subweb.nsf/all/B5119F104F0F2C4C48257B6700252E37/$File/UMSNGB-AnnualReport2012.pdf (Page 7)

接下来,要进入主要的重点了。

让我们先进入一些关于公司的生产线的资料(源:公司的网页)。

Let's go for the attractive point. Before this, let's have a look on the company operation capacity info. (Source: Company's website).

UMSE started off initially by supplying 2 types of products for the Malaysian market with a production capacity of approximately 400,000 units per annum. As business grew due to increasing demand for its products and to cater for the increase in its products range, UMSE in 1994 moved to a wholly-owned, larger and better-equipped premises in Lot 5, Batu 17 1/2, Jalan Ipoh, Rawang Industrial Estate, Rawang, Selangor Darul Ehsan measuring 49,020 square feet, with a production capacity of approximately 5,000,000 units per annum. In line with this, UMSE increased its number of employees to more than 300 peoples until today.

In 1993, with increasing global demand, UMSE began exporting its products. In its efforts to increase production capacity and meet demands for its products in both the Malaysian and foreign markets, UMSE increased its production facility at its existing main manufacturing premises and set up additional production lines in a rented facility in Batang Kali, Selangor in 2001. Following this, UMSE's production capacity increased to approximately 9,000,000 units per annum.

>> 49,020sqft = 5,000,000 units per annum > 9,000,000 units per annum

On 1 July 2004, UMSE then relocated its production facility in Batang Kali, Selangor, to a new, wholly-owned plant located at Lot 659, Jalan Bukit Rawang, Taman Bukit Rawang Jaya, Batu 20, 48000 Rawang, Selangor Darul Ehsan which measures 21,200 square feet with a production capacity of 7,400,000 units per annum. The total production capacity as at the end of 2005 was 16,000,000 units per annum.

>> 21,200sqft = 7,400,000 units per annum > 16,000,000 units per annum

新闻(1):买厂

News (1) : Buy Factory

UMS-NEIKEN

GROUP ACQUISRES FACTORY IN SINGAPORE FOR SGD1.41M (RM343M)

CLASSIFICATION: ACQUISITIONS/DISPOSALS & MERGERS

TYPE: Acq/Disposals/Mergers & Subscriptions/JVCOs/Demergers

10 February 2010

UMS-NEIKEN GROUP reported that 50% owned NEIKEN SWITCHGEAR (S) pl had on Feb 8, 2010 entered into an Agreement to acquire from CHIU-TENG @ TAGORE pl a one-storey factory on Tagore Lane, Singapore for a total consideration of SGD1.41m (RM3.43m), to set up its warehouse and office buildings.

CLASSIFICATION: ACQUISITIONS/DISPOSALS & MERGERS

TYPE: Acq/Disposals/Mergers & Subscriptions/JVCOs/Demergers

10 February 2010

UMS-NEIKEN GROUP reported that 50% owned NEIKEN SWITCHGEAR (S) pl had on Feb 8, 2010 entered into an Agreement to acquire from CHIU-TENG @ TAGORE pl a one-storey factory on Tagore Lane, Singapore for a total consideration of SGD1.41m (RM3.43m), to set up its warehouse and office buildings.

>> 291sqm

= 3,133sqft

>> The

expected date of delivery of vacant possession of the Property shall be not

later than 30 June 2012 and the expected date of completion of the Sale and

Purchase Agreement of the Property shall be no later than 30 June 2014.

>>

The

Acquisition of the Property is used for setting up the Group’s own warehouse

and office building in expanding and diversifying more range of products as

well as the business operation in Singapore in long term.

http://www.bursamalaysia.com/market/listed-companies/company-announcements/57694

http://www.bursamalaysia.com/market/listed-companies/company-announcements/58023

新闻(2):又买厂

News (2) : Buy Factory again

UMS-Neiken

unit buys land in Selangor

by hlk on

Mon 01 Aug 2011, 21:02

UMS-Neiken

Group Bhd's wholly-owned subsidiary, UMS-Neiken (M) Sdn Bhd (UMSN), is

acquiring a leasehold vacant land in Selangor from Federal Poultry Industries

Company Sdn Bhd for RM2.036 million.

In a filing to Bursa Malaysia today, UMS-Neiken said the company intended to construct a new warehouse on the land measuring approximately 92,558.49 sq ft for use by the company and/or other subsidiaries.

UMSN is principally engaged in the marketing and trading of electrical products and accessories.

The acquisition will be satisfied entirely in cash, which will be financed through internally generated funds and/or external bank borrowings.

The exercise is expected to be completed by the first quarter of next year. -- Bernama

In a filing to Bursa Malaysia today, UMS-Neiken said the company intended to construct a new warehouse on the land measuring approximately 92,558.49 sq ft for use by the company and/or other subsidiaries.

UMSN is principally engaged in the marketing and trading of electrical products and accessories.

The acquisition will be satisfied entirely in cash, which will be financed through internally generated funds and/or external bank borrowings.

The exercise is expected to be completed by the first quarter of next year. -- Bernama

http://www.bursacommunity.com/t3514-ums-neiken-unit-buys-land-in-selangor

>> 92,558 sqft

>> the Acquisition is expected to

be completed by the first quarter of 2012. (注意Q1FY12过后的业绩!)[ATTN: see the result right after Q1FY12!]

http://www.bursamalaysia.com/market/listed-companies/company-announcements/861564

新闻(3):再买厂

News (3) : Buy Factory again and again

UMS-NEIKEN

GROUP ACQUIRES PROPERTY IN SINGAPORE FOR RM7.1M

CLASSIFICATION: ACQUISITIONS/DISPOSALS & MERGERS

TYPE: Acq/Disposals/Mergers & Subscriptions/JVCOs/Demergers

17 January 2013

UMS-NEIKEN GROUP reported that 50%-owned NEIKEN SWITCHGEAR (S) pl had on Jan 8, 2013 entered into an Agreement to acquire from CHUU TENG 8 pl one unit of light industrial factory with ancillary offices on the first floor in Tagore Industrial Avenue for SGD2.8m (RM7.1m). The building is yet to be completed, and the Company expects to be delivered vacant possession no later than end Dec 2015.

CLASSIFICATION: ACQUISITIONS/DISPOSALS & MERGERS

TYPE: Acq/Disposals/Mergers & Subscriptions/JVCOs/Demergers

17 January 2013

UMS-NEIKEN GROUP reported that 50%-owned NEIKEN SWITCHGEAR (S) pl had on Jan 8, 2013 entered into an Agreement to acquire from CHUU TENG 8 pl one unit of light industrial factory with ancillary offices on the first floor in Tagore Industrial Avenue for SGD2.8m (RM7.1m). The building is yet to be completed, and the Company expects to be delivered vacant possession no later than end Dec 2015.

>> 319sqm

= 3,435sqft

>> UMSN expects to complete

the Proposed Acquisition not later than 31 December 2018

or 3 years after the date of

delivery of vacant possession of the Property, whichever is

earlier.

http://www.bursamalaysia.com/market/listed-companies/company-announcements/1170681

新闻(4):又再买厂

News (4) : Buy Factory again, again and again

UMS-NEIKEN

GROUP ACQUIRES FACTORY/OFFICE IN RAWANG FOR RM11.0M

CLASSIFICATION: ACQUISITIONS/DISPOSALS & MERGERS

TYPE: Acq/Disposals/Mergers & Subscriptions/JVCOs/Demergers

07 February 2013

UMS-NEIKEN GROUP reported that 100%-owned UMS-NEIKEN (M) s had on Feb 6, 2013 entered into an Agreement to acquire from KG POWER (M) sb a single-storey factory and 3-storey office building on 12,342 sq m of land in the Rawang Integrated Industrial Park for a cash consideration of RM11.0m.

The acquisition is for the Group's future expansion plans.

CLASSIFICATION: ACQUISITIONS/DISPOSALS & MERGERS

TYPE: Acq/Disposals/Mergers & Subscriptions/JVCOs/Demergers

07 February 2013

UMS-NEIKEN GROUP reported that 100%-owned UMS-NEIKEN (M) s had on Feb 6, 2013 entered into an Agreement to acquire from KG POWER (M) sb a single-storey factory and 3-storey office building on 12,342 sq m of land in the Rawang Integrated Industrial Park for a cash consideration of RM11.0m.

The acquisition is for the Group's future expansion plans.

>> 12,342 sq m = 132,923sqft (whole piece land)

>> Factory = 60,767sqft,

Office & factory Building = 8,965sqft, Utility = 10,666sqft

>>

Expect to complete by FY13Q2

http://www.bursamalaysia.com/market/listed-companies/company-announcements/1193329

http://www.bursamalaysia.com/market/listed-companies/company-announcements/1198037

1)低估。现在的价PE才5.x。还没考虑未来新厂的贡献。

2)股息稳定。现在的价,少少有4%多的股息率。未来成长会变得更多。

3)公司买很多产业来增产。需要时间见效。现在买入是因为这个价已经很便宜了。未来增长,代表更便宜。

4)最近有基金和股东交易。占了3.x%。平均价应该在36sen范围。这个股的流动票很少。这个数目算很大了。主要是看到KP FELDA基金换手给其他人。(YEO GUIK HIANG)

5)股数少。才80mil。容易炒。(哈哈!)

6)越南的厂将会重新运作。管理层讲是为了减低运作费,因为最低薪金的关系。但是我预测公司也打算在那边发展。毕竟越南的基建和房产还有很大的上升空间。

7)最低薪金已经完全反映在Q1FY13的业绩里了。但是Q1FY13的业绩也很不错。这样证明管理层在管理运作费和生产效益满不错。

8)最近4个季的业绩,平均都有EPS 2sen多。如果经济没有大倒盘,预测业绩至少可以维持或提升。(参考买厂的新闻)

9)个人认为,比起邻居(新国,中国,香港),大马的房地产还算便宜。只要房地产不倒,生意值还有上升的空间。

10)大马的生意占了80%。香港占了20%。大马的业绩有明显提升。香港开始2008年已经到了顶点。接下来,主要是靠大马的贡献。也期待越南能带来正面的消息。

这样低估又有前景的公司,还需等待更便宜的股价吗?如果能做到更低的价位,真的恭喜大家!

Summary:

1) Undervalued. Current share price, it is rating at PE 5.x. This is yet consider of contribution from those acquired factories in the future.

2) Dividend is very consistent. With current share price, its DY will be 4% plus. It will be more when company is growing.

3) Company acquired few factories to increase its capacity. It may need time to get thing done. Current share price is cheap. With capacity increase in future, it mean the current share price is even cheaper.

4) Recent share exchange between KF FELDA and YEO GH is more than 3%. It is a huge traded volume for this company. I guess the average share price will be around 36sen. Something good behind this changeover?

5) Number of share issued is very low. Only 80mil. It is easy to "speculate"!

6) Vietnam factory will re-commence its operation in 2nd half of 2013. According to management, it is to reduce cost due to minimum wages. But I guess the company also trying to explore the market there since infrastructure and property sector still have more room to grow.

7) Minimum wages already reflected in Q1FY13 result but it still looking great on the figure. This proved the management did a good job in cost control and operation efficiency.

8) For the rolling 4 quarters result, averagely each quarter come with EPS 2sen plus. If there is no economy crisis, I expect its result will at least able to maintain or become better. (refer to new factories being acquired.)

9) Personally, I feel that Malaysia property is still very cheap compared with Singapore, China and HK. As long as the property sector still doing good, company revenue should able to grow further.

10) Malaysia business contribution is about 80%. HK captured another 20%. Malaysia result is on uptrend whereby HK segment already reached its peak at 2008. Next, Malaysia segment will play a big role to sustain the company grow. Hopefully, its Vietnam operation will bring a great news in future.

The company is undervalued and also come with good prospect. Thus, I don't expect any more cheaper share price to offer. If yes, then you are so lucky to buy at much cheaper value!

No comments:

Post a Comment