之前都没打算写每季的报告分析,毕竟现在到2015年的目标还有一段很长的时间。但是看了昨天的Q1业绩,真的有点失望。之前我预测至少有EPS=1sen以上。看了这样的业绩,预测接下来的短期时间,股价很大可能没什么作为了。虽然比起去年Q1FY12的业绩好,但是还是达不到我个人的标准。

Initially, I don't plan to write every single quarter result analysis as the company target is based on year 2015. Due to Q1 result, the figure is a bit disappointed me. Basically, I estimate it can at least hit eps=1sen or above. With this kind of result, I don't expect the share price to continue its impressive trend in short term. By compare its Q-Q result, it looks better. But still failed my own expectation.

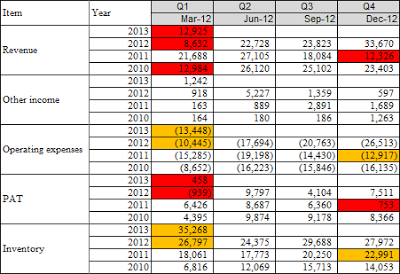

先让我们看以下资料:

1. 过去三年里(2010-2012),公司总共投资了24mil来增产。

2. 管理层曾经透露增产的活动暂时已经足够了。但是,看了Q1FY13的资料,原来在这季也有动用了1.1mil来增产。扣了这个费用,其实这季的业绩,大概有0.5sen的EPS。

Let's have a look on below details:

1. From the past 3 years (2010-2012), company had invested 24mil for expansion purpose.

2. According to management, the expansion activity is enough. But, when we look into Q1FY13 details, actually there is another 1.1mil used for expansion activity. If neglect this figure, this Q should get about eps=0.5sen.

|

| Cash Flow from Investing Activities |

4. 在2012Q1和2013Q1的低潮中,公司的运作费用都是高过营业量。超高的运作费用,主要都是来自突然高涨的存货。最近这季既然多了7.3mil的存货。看到了这个变化,可以联想到的原因有三个,(一)是为了接下来的供应而囤货(二)是因为顾客推迟订单(三)是因为顾客取消订单。

3. From the past few years record, there will be a bad quarter for each year.

4. Refer to 2012Q1 and 2013Q1, its high operating cost is the main contributor for the bad result. Basically, this high operating cost is generated from the sudden spike in inventory level. This latest quarter, its inventory has increased about 7.3mil. By looking on this change, I was thinking of 3 reasons, (1) to supply for the coming quarter order (2) order push out by customer (3) customer cancelled order.

|

| Correlation Indicators |

5. Management expect a better result in coming quarters. So, the increased inventory most probably is due to reason (1) and (2). Both are positive effect to company.

|

| Q1FY13 Quarterly Report's Prospect |

注意:

1. 存货高涨7.3mil是在2010-2013年里的最高水平。其次是Q3FY12,增加5.3mil。接下来的Q4FY12交出来一个漂亮的业绩(也是营业量的历史新高,33.67mil)。

2. 存货相等于产品大部分的成本。如果(大概预测)产品卖出后的盈利是10%,那么7.3mil的成本将能带来**8.1mil的营业量。(**更改)

这是个危机,还是个机会?

如果你在最近买入【伟特机构】,那你是为了短期赚取盈利而买,还是为了买公司在2015年的未来?

以下是我个人的建议与策略:

》短期 - 我的建议是卖掉你手上的票。因为我预测短期股价很难有更高的上升空间。(除了有预想不到的利好公布)

》长期 - 暂时守着你手上的票。如果股价跌到60+sen或更低,可以慢慢加码。

也许大家可以看到经济不大好,但是暂时我还看不到差到像2008年风暴那样的情况。所以,我对公司未来的成长,个人的200mil目标,还是继续看好。

你手上的一票,由你自己决定。买卖自负。

ATTN:

1. Inventory increased by 7.3mil by this quarter and it is the highest level since year 2010-2013. It follow by Q3FY12, which increased about 5.3mil. As a result, the Q4FY12 came with a great result, which is the highest quarter revenue at 33.67mil.

2. Inventory equal to most of the product cost. If (just a simple estimation) the PAT margin is 10%, then the extra 7.3mil inventory will contribute of 8.1mil in revenue.

Is this result a disaster or an opportunity?

If you just bought in VITROX recently, you should think about whether you get in for short term trading or for the company 2015's target.

Below is my suggestion on the investment strategy:

> Short term - sell off your share because I expect the share price hardly to further impressive you unless there is any unexpected good news from company.

> Long term - hold your share and top up slowly if share price drop to 60sen+ or below.

Most of the people may not see good on the current economy. But it still better than the 2008 crisis situation. Thus, I still looking good on the company to achieve the 200mil revenue (personal target).