Follow FB Page @ https://www.facebook.com/Y2K.Invest4Living/

《千年虫》投资网站 @ Y2K Investment Blog

基本面投资的威力 The power of fundamental analysis investment

Monday, 9 June 2025

【虚拟】股息投资组合@第三年回酬检讨

Follow FB Page @ https://www.facebook.com/Y2K.Invest4Living/

Tuesday, 3 June 2025

股息投资组合@季度业绩审查(MAR 2025)(REDTONE, OFI, DKSH & 3A),组合变动

REDTONE

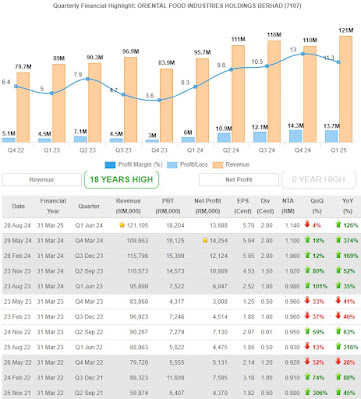

OFI

DKSH

3A

Sunday, 9 March 2025

股息投资组合@季度业绩审查(DEC 2024)(REDTONE, OFI, DKSH & 3A)

REDTONE

OFI

DKSH

3A

Tuesday, 7 January 2025

2024年【大盛小弱】

去年预测2024年将会是一个好年,但只是猜中了一半。

正如去年预测,大马股市确实迎来了已久没有那么顺利的上半年。遗憾的是,在 7 月之后,小盘股指数立即变得极其悲观。另一方面,吉隆坡综合指数在 9 月底之前一直保持乐观,然后就开始下跌。但整体而言,吉隆坡综合指数依然保持强势,也创了自从2010年以来的年度最好回酬率。

逻辑上, 小型股应该会跟随综合指数趋势,或者走势也不会太弱,但真实却没发生。然而,自己在年中调整投资组合后,忽略了以上的因素。也应如此,年中与下半年尝试买入新股做投资,自然地被小型股的弱市而被套。

【2024年新投资的检讨篇】

2024年的股市,一开始就非常旺盛,持续了半年。在年中,其实自己已经意识到了股市回调风险的存在,所以就开始执行风险管理,把组合数量缩小,也顺便瘦身。开年到此刻,差不多每个投资决定和操作都非常顺利,也是跟着计划那样则行。

但,接下来就是失策的开始。。。

也许上半年的回酬来得太容易,轻易就突破个人回酬纪录,回酬率也非常亮眼。也许这样,无形中让自己放松了选股的准则,因为“本钱”多了,认为有比较多的本钱可以承受接下来的风险。加上个人认为大马股市将会在下半年持续走强(预测只会调整一阵子),怕失去多年久别的大牛市行情,所以年中所完成的风险管理决策开了一个缺口。也应如此,2024年的新投资目标,4个选择里,就有2个被套(暂时),出错机率是50%,也是近年来新投资出现最多状况的一年!

错误(1)

导火线是,没有认真审查得到的信息对比发酵的时机点,导致打听与证实的资讯出现时间上的差错。一旦这样的失误出现在前瞻性的投资策略,除了等待的时间被拉长,切入点的价钱也会出现不少的差别,尤其是在外围经济复苏/成长预期被延误的状况。这是信息的差错,加上投资者没有做好资料审查(double check)所导致的失误。

此战,其实已筹备已久,可惜没有跟着个人部署的计划则行,因为信息的时间差导致提早下手。虽然此投资暂时被套着,但预测未来还会能带来不错的回酬,只是错失了最大盈利化的效果。

错误(2)

主要原因是:“无形中让自己放松了选股的准则,因为“本钱”多了。” 完成年中的组合调整后,资金也多了,加上怕错失大牛市,自己也急着找新投资目标。此投资出现两个失误:(1)只看基本面数据,没有深入检查前几年的公司公告。(2)以最快与懒惰的方式,只打听第三方的信息去做投资决策。听说管理层为人不错,未来生意扩张的部署,加上公司的财务部也非常健康,所以就非常儿戏就投入资金。被套期间做了更多的研究,慢慢发现有更多不了解的疑问,但没有很好的管道去得到答案。

此投资,虽然被套着,但以公司的每股净现金来衡量,股价应该不会再变得太糟糕。这是此投资早期所看到的一个护身符,希望能发酵。故事暂时有跟着”听说“的剧本走,希望剧情不好出现延误,不然就必须被圈着鼻子走。这也是自己比较不喜欢的投资方式。

正确(1)

年尾算有小赚,但勉强来说还是有点小错误可以改善。此投资属于比较大波动的个股,在高风险时期,必须做一些操作来防护手上的投资,简单来说就是自救。可惜自己却没做到,因为不够谨慎,被组合回酬好景延误,错失最佳操作机会。自己还是非常看好此投资,因为未来公司的生意模式将会非常稳定,加上有政府政策与行业趋势的加特。只要管理层肯努力,走在对的路到上就会很容易成功。经过3个季度的忍耐后,终于迎接了第一道曙光。虽然暂时股价没有出现太明显的反应(某某人趁弱市持续去压制他?),有朋友帮忙长期深入了解公司,相信此投资在2025年会开始看到不错的表现。继续持有的念头不变。

正确(2)

此投资,功课和资讯足够,得到机会了解管理层,加上核心业务非常稳和有成长动力,其实不难做投资选择。意外的是,公司开始投入新能源业务,了解后非常有吸引力。就算未来新业务不成功,以核心业务做衡量,也不会亏到哪里去。经过多个月的进展跟踪后,认为新业务变得越来越证实。次投资的果实,也慢慢成熟中。

【2024年原有公司的检讨篇】

至于手上两个最大的主力(零成本),预测2025年将会是两者的一个好年。

(1)K股

管理层已经在近期的季度报告,年度报告,年度大会,多次讲解公司在2025年将会是一个更好的年份。虽然公司所做的产品看来很传统,没什么高科技感的样子,加上投资者也不了解公司的顾客或产品的背景。公司所供应的产品,7-8成都是来自非常有知名度的日本牌子。与日本公司做生意,讲求的是实力和品质,还有就是粘性度非常高。要与日本人做生意,谈何容易?单单这个因素,内在价值已经是非一般。

公司在大马的业务,持续稳固,高盈利率的产品占有率也慢慢提升中。至于越南的业务,过去2-3年所完成的两间新厂扩充,也许今年会开始看到比较明显的效应。公司的越南业务,还是潜在非常大的成长空间,未来2-3年的扩张能见度其实也非常高。如果公司未来能再扩张新厂,笔者也不觉得意外,简直是锦上添花!

虽然是冷门与流动量低的公司,但笔者一点担心都没有。也许未来将会转化为流动票供不应求的利好?吃这类型的大茶饭,也是个人的强行。去年平平无奇的股,希望今年开始会有看头。

(2)R股

投资者也许因为大股东不好的前科,认为比较难吸引到基金经理的参与。事实证明,好料的东西,自然会吸引到识货之人。公司的30大股东名单,去年开始已由投资机构填满。

虽然去年开了一个好头,但是下半年却被有心人压制,全年回酬率不到3成,只算合格。每当遇到这种状况,笔者都先不会勉强去反击,而会顺他人之意,避免让自己陷入两难的状态。但,一旦压制过程出现够吸引的深度,自己也会顺他人之意,强逼自己多买一笔,来补偿被他人作弄的精神损失。技术图很糟糕是吗?确实很糟,也是特地要让你我看的!

公司的估值还是维持二等级别,与其他讨人喜爱的主题股完全没得比。以生意模式的吸引力来做比较,笔者认为R公司是一等级别的料,那些大部分被大炒到估值非常昂贵的小型股都是2-3等级别,没得比!(呵呵~当然卖花赞花香吗!)。排除一次性的因素,2025年明显是公司更旺盛的一年。今年也有不小的新催化剂(希望能在今年内看到),完全没有离场的理由。

(3)其他:未来有缘才谈。

【简单分析虚拟股息组合的个股】

前景会变更好的名单:REDTONE,OFI,DKSH,3A

前景有特观察的名单:SCICOM

前景还不明朗的名单:BJFOOD

1. REDTONE

盈利动力来源:MTNS进入Peak Development阶段,MAMPU合约开始贡献,数码化蓬勃发展。

2. OFI

盈利动力来源:得到更多顾客做OEM食品。

3. DKSH

盈利动力来源:食品和医疗业务继续扩张。

4. 3A

盈利动力来源:主要的原料成本下降。

【2025年投资策略】

专注于那些跌到很深,但未来有能力复苏的个股。今年比较特别,可以选择那些公司,不用是非常优秀,但必须有诚信,认真和努力做生意的管理层。原因?那些非常优秀,生意前景比较好的公司,估值都不便宜。跌深的复苏股,一旦出现利好,反弹的力度都会非凡。

行业关注:

1. 数码化科技(5G,Cybersecurity,等)

2. 半导体科技

3. 消费食品业

4. 其他:传统工业,能源业,制药业,等。

【结尾】

以【大盛小弱】的主题来总结去年的状况。意思去年属于大型股旺盛的一年,小型股反而在下半年出奇地进入弱市。也应误判小型股的下半年走势,导致2024年的回酬回吐不少。但,还是得到一个满意的成绩。可算是能赚钱,又能赚到非常宝贵经验的一年!

虽然持续看好大马股市的发展,基于美股已经连续大涨了2年,所以2025年的投资会来得比2024年多一份谨慎牌!

以上都是个人的浅见,谢读此娱乐版文章。

未来你的投资策略,如有雷同,纯属巧合。

Follow FB Page @ https://www.facebook.com/Y2K.Invest4Living/