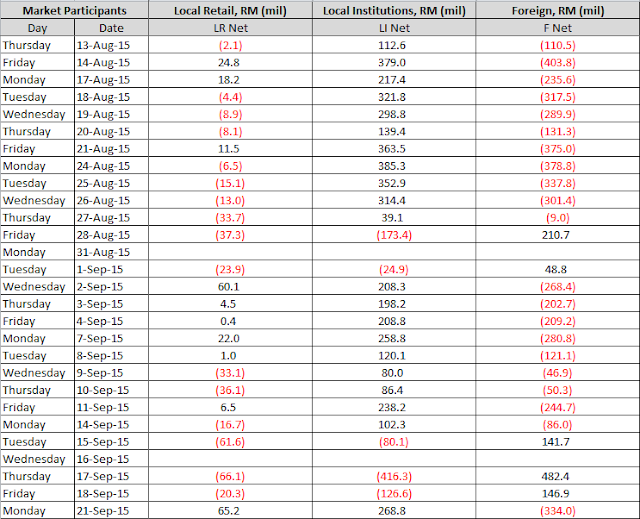

26个交易日,外资就卖了21天。上3个交易日,外资买到比较有诚意,但是今天就突然翻脸变卖家。到底接下来的走势会如何发展?

个人追踪了此数据已经有三年多了。但是还捉不到数据背后的真正巧妙灵感。也许需要更多的数据时间来观察。也许多加一到二个牛熊市。

2012年5月算起,外资累积了一年的票直到2013的5月。过后就一直卖到现在。卖出的市值是2012-2013所累积的1.5倍。会多吗?如果把考虑的范围从2009-2012的五月前累积的票也算在里头,个人认为不会多。可以肯定的是,那1.5倍市值被出售的票,肯定赚翻了,也成功把指数维持在高水平。

如果纯属猜测,笔者比较导向更低的指数走势。外资的前3个交易日为何买入?是不是为了推高卖股的空间(推指数高)和得到更多的卖票权(制造卖压)?没有一个答案。唯有继续观看接下来的股市进展。更重要的是,笔者还没有以前大事进场的胆量,因为已经不大会投资在现有的市场了。

From the listed 26 number of trading days, foreign investor (F) has sold in 21 days. From the recent 3 trading days, (F) bought back some significant value of shares. But, (F) made an immediate U turn today. How the show is going on after this?

I tracked such trading data for more than 3 years and still counting. Anyway, I'm still unable to get some solid hints from such trading data analysis. I guess I still need much more time on this. Perhaps need to add on 1 to 2 bullish and bearish market.

Started from May'12, (F) is accumulating share until May'13. It follow by unstoppable selling mode until today. The sold traded value is 1.5 times compared to its accumulation from 2012-2013. Is it a lot? I don't think so if we consider its accumulation since from 2009-2012 which is not under my tracking database. One thing to be sure that, (F) has got good profit from its 1.5 times sold traded value in share and still maintain the index in reasonable high level.

By pure guess, author is more toward to further downside for index. What is the reason for (F) bought back in recent 3 trading days? To create more room for selling (push up the index) and get more share for control power (make selling pressure)? No answer for it. Just continue to see the coming market show. Anyway, I strayed in such market condition as I dare not to buy big as what I did in the past.

LR - Local Retails 【散户】

LI - Local Institution 【本地基金】

F - Foreign 【外资】

1 comment:

不错的资料,谢谢用心。

从图表来看,是本地投资机构与处资的角力。 线是倒反的影子,你买我卖, 我卖你买。

Value cap 的出现,处资乘机作戏,买一把,此乃诱敌之计。

Post a Comment